Some founders may not like it, but in the first few months and years, money is a prominent topic to which almost everything else has to be subordinated. Business is in an intensive phase – there is often no time to focus intensively on financial management.

But this is precisely what is literally vital for the economic development of the young company. If you don’t set clear payment deadlines or lose track of income and expenses, you risk stalling cash flow – and with it the entire company. In this environment, digital control of money flows is not just a “nice to have”, but rather the most important survival factor.

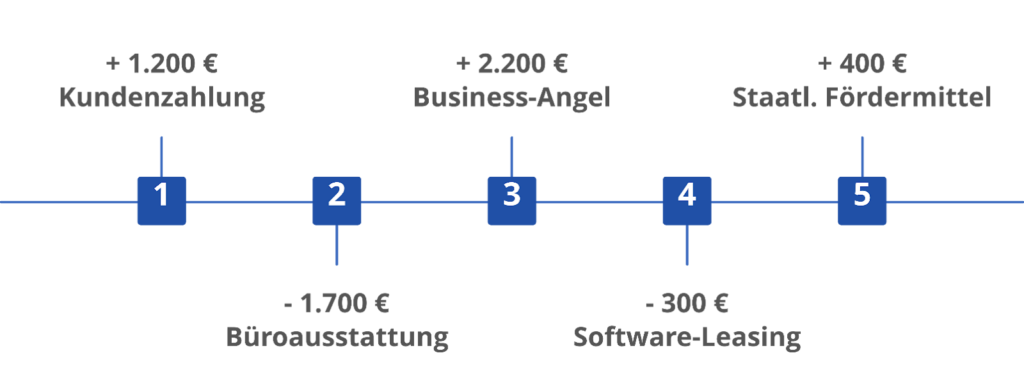

Anyone founding a startup will very quickly come into contact with the concept of cash flow. Cash flow describes the actual cash flow of a company – i.e. how much liquid assets are available at a certain point in time.

This is a key indicator of the financial health of their company, especially for startups. A company can look profitable on paper and still run into financial difficulties if, for example, invoices are paid late or high expenses cannot be covered because revenue arrives too late. The cash flow shows the real solvency and thus the short-term viability. In contrast, profit shows how successful the company is from an economic perspective.

Cash flow is very susceptible to fluctuations, especially in the start-up and growth phase. Even small irregularities can have a threatening effect – with consequences for supplier relationships, salary payments or your own creditworthiness.

Simplified cash flow diagram

Invoices paid on time are the heart of cash flow. Because invoices only arise from the work of the company. All other cash receipts come from other channels. But the young company can only plan further with the proceeds once payment has been received. To ensure that liquidity bottlenecks do not arise in the first place due to missing or late incoming payments, payment flows must be actively managed.

- Determination of suitable payment terms

An important lever is the design of payment terms. Instead of 60 days, as is common in some industries, 14 or a maximum of 30 days can also be agreed. The shorter the payment term, the faster the money flows back into the company.

- Use of digital tools

Digital tools such as sevDesk, FastBill or Lexoffice can save considerable time in this process. A good invoice software not only creates professional invoices, but also tracks the payment status in real time.

The entire process from invoicing to booking is significantly accelerated by these two measures alone. Anyone who digitizes financial processes not only reduces the risk of bottlenecks, but also gains valuable time for operational business.

Many startups work with equity or with sponsors who support their idea. However, sometimes credit financing can also make sense in certain phases – for example, if inventory needs to be further built up due to high demand. But what situations are these?

Start-up financing – the most important credit opportunity

If the business model is in place, the first customers are available and the company wants to scale by building a team, investing in technology or marketing, a loan helps to obtain the necessary funds. There are also three other situations in which a loan can be the right choice:

Especially in very early phases with fluctuating income, it is not always easy for a young company to obtain a traditional loan. The house banks check, among other things, the creditworthiness of the founders, existing collateral and previous sales.

This means that start-ups can also get a loan

If you are a start-up without a long business history and want to apply for a loan easily, the best way to do this is through digital credit platforms. They usually offer much more flexible options than house banks, work with simplified application processes and use alternative scoring models. Microloans with short terms can also be a solution if smaller amounts are needed in the development phase. However, the offers differ greatly in term, interest rate and requirements – it’s worth comparing.

If you want to realistically estimate your own monthly burden, you can run through various scenarios online in advance using a loan calculator. In this way, terms, installments and interest costs can be compared transparently – an important basis for well-founded financial decisions.

Startup jobs: Looking for a new challenge? In ours Job exchange You will find job advertisements from startups and companies.